The Comsefaz committee is expected to vote on Thursday to raise the ICMS rate on imports from 17% to 25%, impacting purchases on platforms like AliExpress and Shein.

Summary of essential information: do

- The ICMS rate for imports may increase from 17% to 25% by 2025.

- Imports have decreased by over 40% by 2024 following modifications in the Remessa Conform program.

- Billionaire losses from posts are recorded, as national retailers advocate for increased taxes.

Higher ICMS rates will worsen the decline in imports.

Since the Remessa Con program was introduced in August 2024, there has been a significant decrease in international shipments, leading to over a 40% drop in imports. The program’s goal is to stabilize the market and combat tax evasion, but the high taxes have increased the final price of imported goods, deterring numerous consumers.

The potential rise of the ICMS rate to 25% is likely to worsen the situation, particularly since the state tax is already higher than the federal tax rates, which vary from 20% (for purchases under $50) to 60% (over $50).

With the decrease in imports, the Post Office faced significant repercussions, including substantial financial losses for the government and a decline in tax revenue. Despite this, domestic retailers are pushing for stricter tax changes to enhance their competitiveness with foreign goods.

What can we expect in 2025?

If the new ICMS rate is authorized, Brazil will solidify its position as one of the nations with the heaviest tax load on low-value imports. This adjustment will lead to increased prices for consumers on common items like clothing and accessories, a situation referred to as the “weave rate”.

How much will that cost in reality?

To understand the impact of the ICMS increase on your purchases, let’s consider a product priced at $100, bearing in mind that the current exchange rate is $1 to R $6.07. Therefore, a $100 product would cost R $607 in Brazil.

Let’s proceed with the calculation.

- Product worth: R$ 607.00

- Import Fee: A 60% fee of R$607.00 amounts to R$364.20.

- You will pay a total of R$971.20, comprising R$607 and R$364.20.

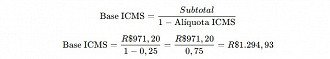

The ICMS should be taken into account when calculating, as it is a tax that is included in the price. If the ICMS rate is 25%, the calculation basis should be divided by 0.75 instead of the full amount.

Therefore, a product priced at $100 will amount to a total of R$ 1,294,93 for the consumer.

The state government justifies the raise as essential for boosting revenue, but is being criticized for potentially worsening economic downturn in the global e-commerce industry.

What are your thoughts on the rise in ICMS? Share your opinion by commenting!